SC ST-388 2022-2024 free printable template

Show details

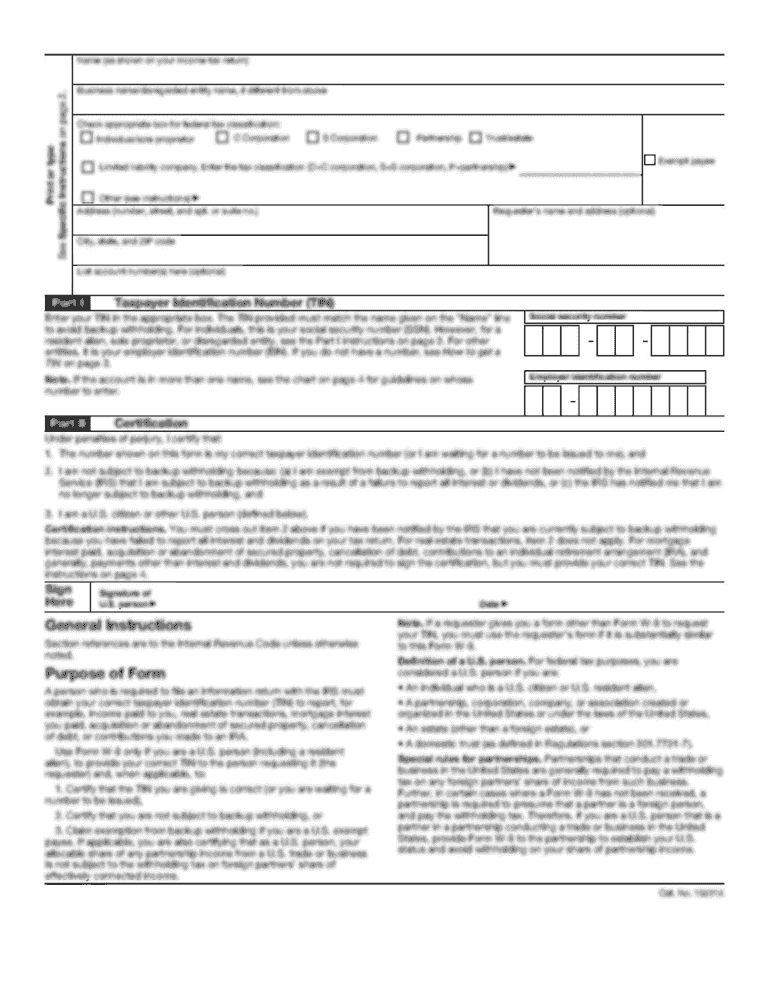

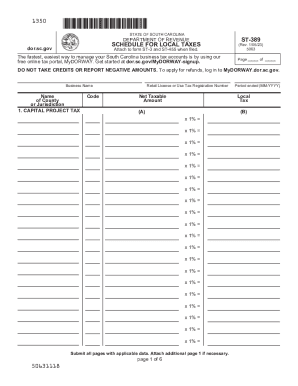

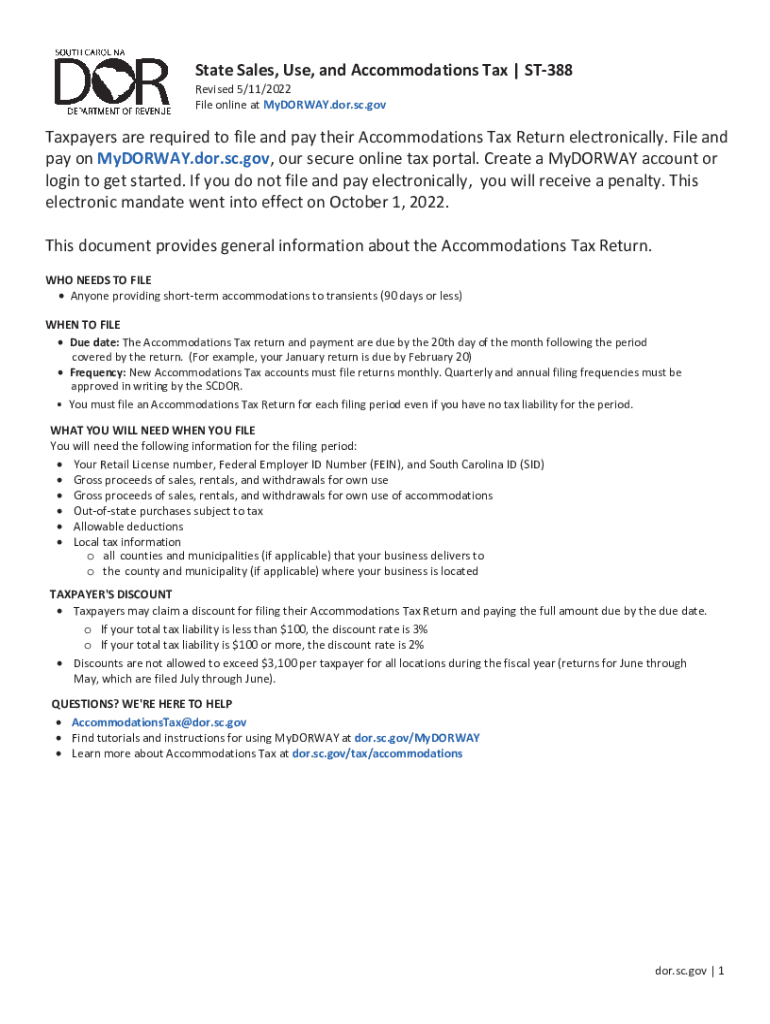

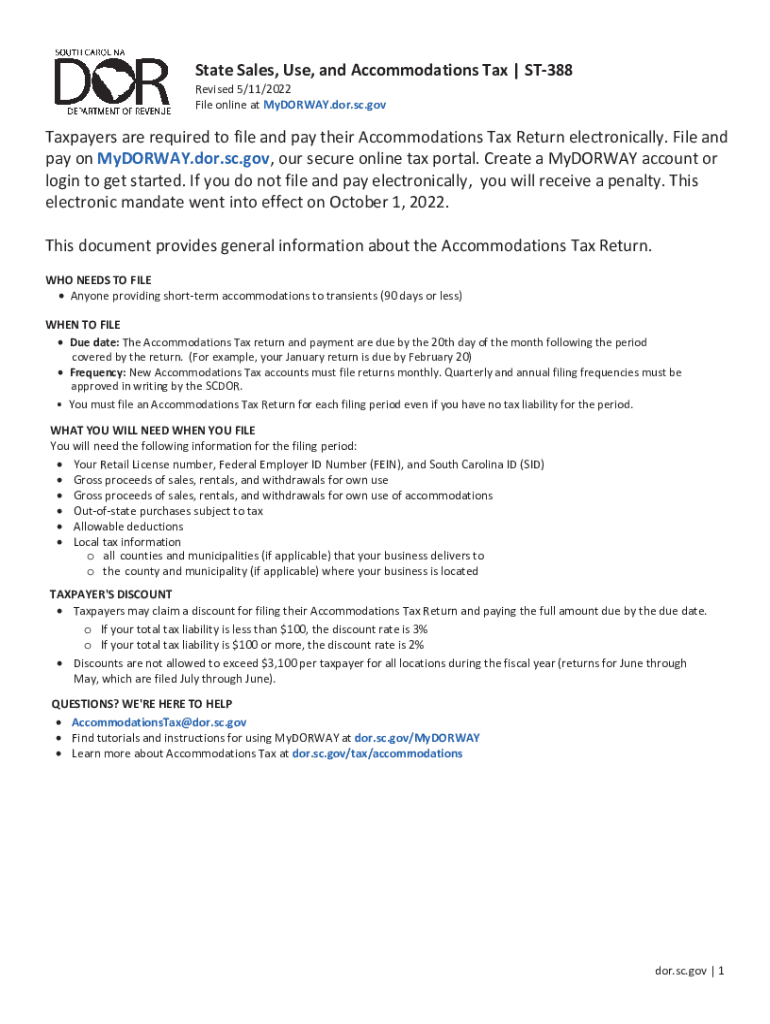

If the area below is blank fill in name and address. RETAIL LICENSE OR USE TAX REGISTRATION FEIN SID Number Period Ended ST-3T must be submitted with Form ST-388. Enter total amount of deductions here and on line 2 Column C on front of ST-388. 16. Item 14 minus Item16 should agree with line 3 of Column C on front of ST-388. STATE OF SOUTH CAROLINA ST-388 DEPARTMENT OF REVENUE Rev. 3/13/18 STATE SALES USE AND ACCOMMODATIONS TAX RETURN dor. Total Amount of Deductions Enter total amount of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your st 388 2022-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 388 2022-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 388 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit carolina state form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

SC ST-388 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out st 388 2022-2024 form

How to fill out state tax:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income or deduction records.

02

Download or obtain the required state tax forms. They are usually available on the state's department of revenue website.

03

Carefully read and follow the instructions provided on the tax forms.

04

Begin by entering personal information such as your name, address, and social security number.

05

Fill in income details, including wages, interest, dividends, and any other taxable income.

06

Report any deductions or credits for which you qualify, such as mortgage interest, student loan interest, or education expenses.

07

Calculate your tax liability based on the information provided.

08

Review the completed tax forms for accuracy and make any necessary corrections.

09

Sign and date the forms before submitting them to the appropriate state tax agency.

Who needs state tax:

01

Individuals who have earned income within a specific state are generally required to file state taxes.

02

If you are a resident of a state that imposes income tax, you will likely need to file state tax returns.

03

Non-residents who have earned income within a state may also be required to file state tax returns, depending on that state's rules and regulations.

Video instructions and help with filling out and completing st 388

Instructions and Help about st 388 form

Fill south carolina st 388 tax : Try Risk Free

People Also Ask about st 388

What is the average sales tax in South Carolina?

Is South Carolina a good tax state?

Which state is more tax-friendly North or South Carolina?

What taxes do you pay living in South Carolina?

At what age do you stop paying state taxes in South Carolina?

Are there tax advantages to living in South Carolina?

How do you calculate South Carolina sales tax?

What is SC tax rate 2022?

Is SC income tax higher than NC?

At what age do you stop paying taxes in SC?

What is the federal tax rate in South Carolina?

What is my state income tax rate South Carolina?

What is the South Carolina tax rate?

Do you have to pay income tax after age 75?

Do seniors pay state income tax in South Carolina?

What is SC special tax?

What is the restaurant tax in SC?

What is the sales tax in South Carolina 2022?

Is South Carolina a tax friendly state?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state tax?

State taxes are taxes imposed by individual states within the United States in addition to federal taxes. These taxes can be income taxes, sales taxes, excise taxes, or other types of taxes. State taxes vary widely from state to state and can be one of the largest sources of revenue for state governments.

How to fill out state tax?

1. Gather your financial documents. You will need to have your W-2, 1099, and other income statements ready.

2. Choose the right tax form. Depending on your state, you may need to file a paper or electronic form.

3. Enter your personal information. This includes your name, address, Social Security number, and other identifying information.

4. Enter your income information. This includes your wages, investments, and other sources of income.

5. Calculate your deductions and credits. Depending on your situation, you may be able to claim deductions and credits that reduce your tax liability.

6. Calculate your tax liability. Use the information you’ve entered to calculate the amount of taxes you owe.

7. File your return. Once you’ve completed your return, file it with the appropriate state agency.

What is the purpose of state tax?

State tax is used to fund state services such as roads, public schools, and health care. It also helps to provide additional funds for state governments to respond to natural disasters, finance infrastructure projects, and support social programs.

What information must be reported on state tax?

The amount of income subject to state tax, the amount of state tax due, and any applicable deductions or credits.

When is the deadline to file state tax in 2023?

The deadline for filing state taxes in 2023 is usually April 15th. However, this date may vary depending on the state.

What is the penalty for the late filing of state tax?

The penalty for the late filing of state taxes varies by state, but generally, the penalty is a percentage of the taxes due, plus interest. In some states, the penalty amount increases the longer the filing is late.

Who is required to file state tax?

The specific requirement to file state taxes varies from state to state. Generally, individuals who have income from sources within a particular state, reside in that state for a certain period of time, or meet specific income thresholds set by the state are required to file state taxes.

How can I send st 388 to be eSigned by others?

When you're ready to share your carolina state form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find st 388 state?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific south state tax and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the sc st 388 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your sc st 388 state tax form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your st 388 2022-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St 388 State is not the form you're looking for?Search for another form here.

Keywords relevant to st 388 instructions form

Related to south carolina st 388

If you believe that this page should be taken down, please follow our DMCA take down process

here

.